Choosing the right business banking account can make or break your company’s financial health. In the UK, where the banking landscape is both competitive and diverse, finding an account that meets your specific needs is crucial. Whether you’re a start-up, a small business, or an established enterprise, the right account can streamline your operations and save you money.

You’ll find various features and benefits across different banks, from low fees to excellent customer service. But how do you sift through all the options to find the best fit for your business? This article will guide you through the key factors to consider, helping you make an informed decision that aligns with your business goals.

Types of Business Banking Accounts in the UK

Choosing the right business banking account UK way can seem challenging at first, especially if you are new to running a business and still have a lot of things to get your head around. You should know that each type of account can serves distinct needs and might impact your business differently, so it’s worth shopping around to get a good grasp of their uses.

Current Accounts

A business current account is essential for daily operations. It allows transactions such as deposits, withdrawals, and wire transfers. Think of it as the heart of your business’s financial activities. Most banks offer overdraft facilities, which can be useful for managing cash flow. Look for features like online banking, mobile app access, and integrated accounting software.

Savings Accounts

Saving diligently can benefit businesses during lean periods. Business savings accounts offer interest on deposited funds, though the rates vary. It’s a prudent choice for businesses wanting to set aside money for future investments or unforeseen expenses. While interest rates might be higher than current accounts, access to funds is usually less flexible. You might want to compare rates and terms to find the best fit.

Merchant Accounts

If your business accepts card payments, a merchant account can help handle those transactions. This specialised account processes card payments, making it easier for your customers to pay. The account facilitates smooth transactions between your business and your customers’ banks. Fees can vary, so consider transaction volumes and the types of cards you accept. Features such as fraud detection and integration with point-of-sale systems can enhance security and efficiency.

Each type of account has its strengths. Consider how each aligns with your business goals. Comparing features and carefully considering options can help you make the best choice.

Choosing the Right Bank for Your Business

Choosing the right bank for your business can feel overwhelming. Many factors could influence your decision. Think about the types of accounts and services offered. Does the bank provide tailored solutions for small businesses? Consider the accessibility of branches and ATMs. Online and mobile banking options matter too. Check the fees that may apply. Are there charges for transactions, withdrawals, or maintaining a minimum balance?

Does the bank offer overdraft protection? Look at their interest rates for loans and credit lines. Evaluate the customer service. You might need support at odd hours. Reputation plays a crucial role. What do other businesses say about them? Investigate the stability of the financial institution. A longstanding bank with a solid history might offer more security.

Comparison of Major Banks

Several banks in the UK stand out in the business banking sector, so let’s take a long:

- HSBC offers a range of accounts. Their startup account provides free banking for 18 months. HSBC is known for extensive global reach which might benefit businesses looking to expand internationally.

- Lloyds Bank has a range of accounts designed specifically for small to medium-sized enterprises. They offer a 12-month fee-free period for new business customers. Their branches are widely accessible.

- Barclays is another significant player with solutions tailored for businesses of all sizes. They offer interest-earning accounts and an extensive network of branches and ATMs.

- NatWest provides a startup package with 18 months of free banking. They focus on offering strong digital banking services which cater to modern businesses.

- Santander offers competitive interest rates on deposit accounts. If your business involves many transactions, this might be an advantage.

Take time to compare these banks. Which services align best with your business goals? What perks and drawbacks are there? Think about how each bank might support your business growth. Keep your long-term objectives in mind.

Essential Features of Business Banking Accounts

Selecting a business banking account involves examining various features. Let’s explore key components that can enhance your financial management.

Online Banking Services

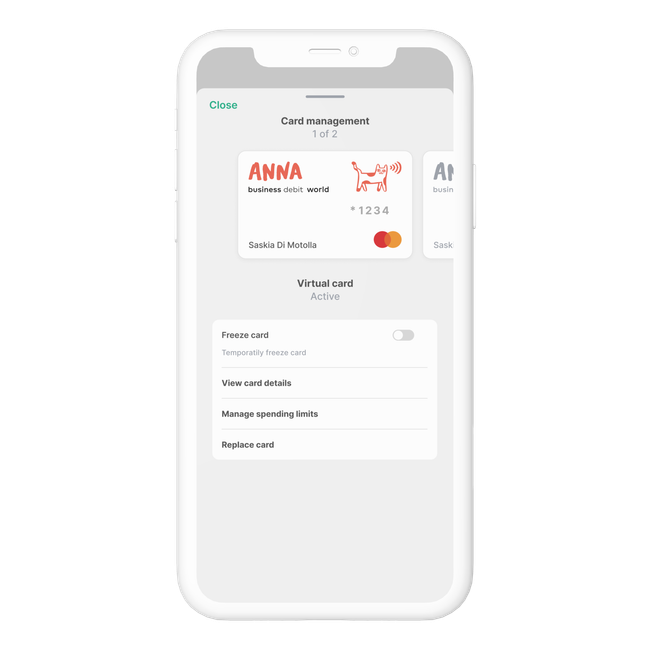

Online banking’s essential for modern businesses. Managing finances becomes simpler with robust online platforms. You can view transactions, transfer funds, and pay bills anytime. Instant alerts and reporting tools help monitor cash flow. User-friendly interfaces should offer easy navigation. Consider security measures—banks often use encryption and two-factor authentication. Look for mobile app services too. Managing your account on the go ensures flexibility and quick decisions.

Loan and Overdraft Facilities

Access to credit is crucial for growth. Business accounts often come with loan and overdraft options. Loans can fund expansions or new ventures. Overdrafts help manage cash flow gaps. Interest rates and terms can vary. Examining these details lets you choose the most cost-effective solution. Some banks offer specific loans for equipment or inventory. Knowing your needs helps tailor financial support. Flexible repayment options can ease your budget concerns.

Transaction Fees and Charges

Understanding fees saves money. Business accounts usually have transaction fees. These might include charges for deposits, withdrawals, or transfers. Monthly maintenance fees could apply. Comparing different banks’ fee structures helps choose the best option. Some banks offer packages with lower fees for certain transactions. Tracking all potential charges informs better financial planning. Awareness of hidden costs prevents unexpected expenses.

Setting Up a Business Banking Account

First, gather essential documents. A checklist saves time. Your company registration number is a must. Bring identification too; a passport or driving licence works. Proof of address like a recent utility bill is vital. If you’re a sole trader, provide your personal bank statements. Partnerships require partnership agreements. Limited companies need incorporation certificates. Memorandums and articles of association are key for corporations. Prepare financial projections if requested. Ensure originals are at hand.

Application Process

Applying is straightforward. Visit your chosen bank’s website. Begin the online application. Fill in personal details, then your business information. Upload the required documents. The bank might call you. Stay ready to answer. You could also visit a branch. Booking an appointment ensures timely assistance. A bank representative verifies details and supports you through the process. Completing the application promptly speeds approval. Get notified via email or phone once processed.

Last Thoughts

Choosing the right business banking account in the UK can significantly enhance your company’s efficiency and reduce costs. By understanding the various account types and considering factors like fees and banking features, you can find a solution tailored to your business needs. The application process, though detailed, is straightforward if you have all the necessary documentation ready. Aligning your banking choices with your operational requirements will support your business growth and streamline your financial management.