Trading options with discipline is essential for long-term success and consistent profitability. Discipline helps traders maintain a systematic approach, adhere to a well-defined trading plan, and control emotions. In this article, we will explore the key steps involved in trading options with discipline.

Establish a Trading Plan:

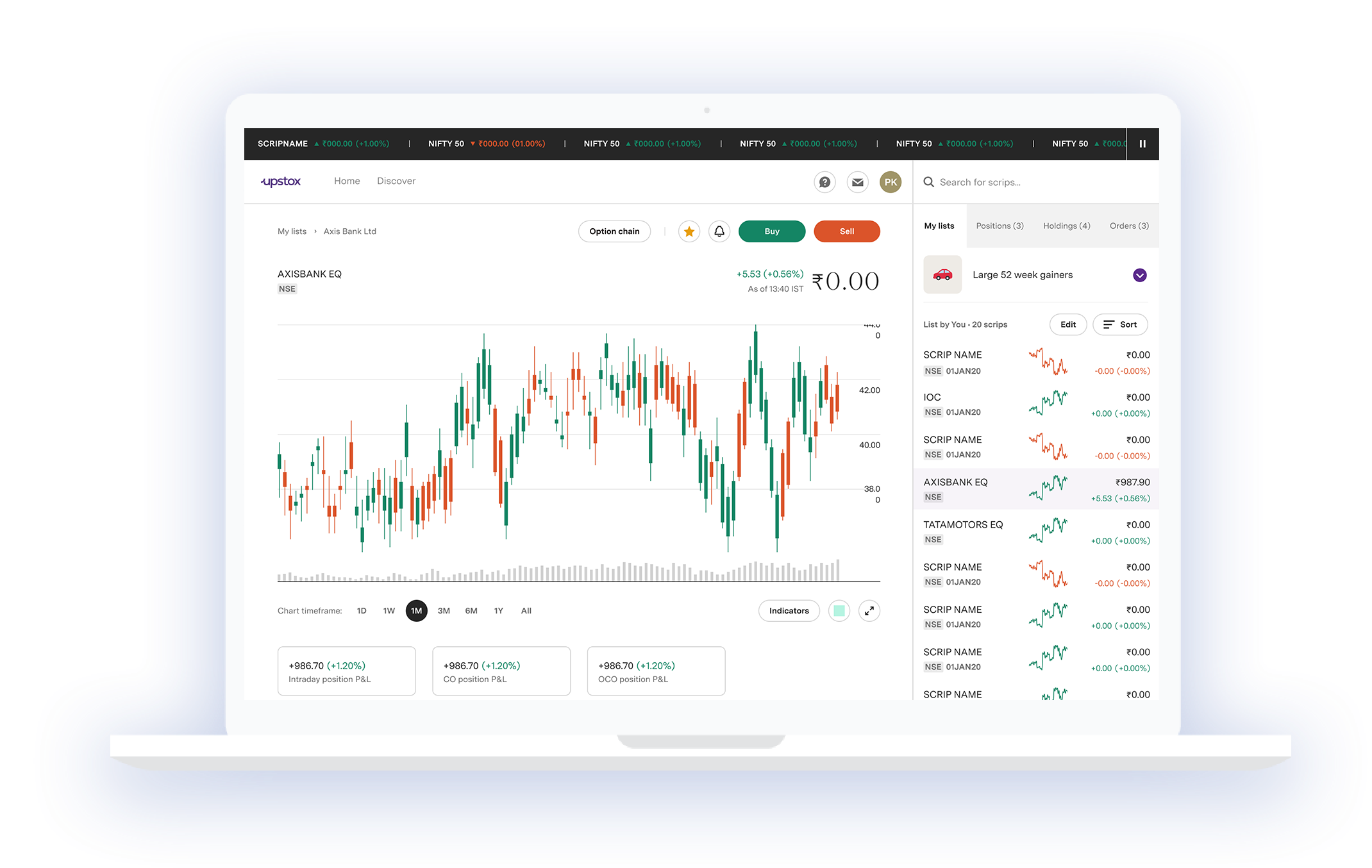

Start by developing a comprehensive trading plan that outlines your trading goals, risk tolerance, and preferred options strategies. Define specific criteria for entering and exiting trades, including technical indicators, support and resistance levels, or fundamental analysis. A well-defined trading plan serves as a roadmap, providing clarity and structure to your trading activities. Check here for more on the nifty option chain.

Set Realistic Expectations:

Maintain realistic expectations about options trading. Understand that it is not a get-rich-quick scheme and that losses are a part of the trading process. Avoid succumbing to the allure of high-risk strategies that promise large returns overnight. Instead, focus on consistent profitability over the long term by applying disciplined and well-thought-out trading strategies.

Follow Risk Management Principles:

Risk management is a cornerstone of disciplined trading. Set clear guidelines for position sizing, maximum risk per trade, and overall portfolio risk. Avoid allocating a significant portion of your capital to a single trade. Implement stop-loss orders to limit losses and take profits at predefined levels. Stick to your risk management rules consistently, even in the face of tempting market conditions. Check here for more on the nifty option chain.

Stick to Your Trading Plan:

Once you have established a trading plan, it is crucial to stick to it. Avoid impulsive trades that deviate from your plan based on emotions or short-term market movements. Trade only when the conditions specified in your plan are met. This discipline will help you avoid chasing trades or making rash decisions that can lead to poor outcomes.

Embrace Patience:

Patience is a key virtue in options trading. Wait for high-probability trade setups that align with your trading plan. Avoid forcing trades or feeling pressured to be constantly in the market. Successful options traders understand that there will be times when the best course of action is to wait patiently for the right opportunity. Check here for more on the Best Trading Platform.

Manage Emotions:

Emotions can significantly impact trading decisions. Fear and greed are common emotions that can lead to irrational behavior. Maintain emotional control and make decisions based on logic and analysis rather than impulsive reactions. Develop self-awareness and learn to recognize and manage emotions that can interfere with disciplined trading.

Continuously Learn and Adapt:

The options market is dynamic, and staying ahead requires continuous learning and adaptation. Keep yourself updated with market trends, new options strategies, and technological advancements. Attend webinars, read books, follow market analysis, and participate in trading communities to expand your knowledge and refine your trading skills. Adapt your strategies as market conditions evolve, ensuring they remain aligned with your trading plan. Check here for more on the nifty option chain.

Trading options with discipline is crucial for long-term success. By establishing a trading plan, following risk management principles, adhering to your plan, and managing emotions, you can maintain a disciplined approach to options trading.