Navigating the financial landscape in the healthcare sector can be quite rewarding, especially for physicians who have the potential to earn substantial incomes while dedicating themselves to saving and enhancing lives. However, the high-income bracket also brings along significant tax liabilities, adding to the financial challenges these professionals face. Coupled with the burden of repaying substantial educational debts, this scenario can impose limitations on their budgets.

The good news is that there are strategies to alleviate these financial challenges and optimize tax outcomes for medical professionals despite their high-income status. In the sections below, we’ll explore some essential tips for tax reduction, specifically tailored to physicians and other high-earning individuals in the medical field. These insights aim to empower healthcare professionals to preserve more of their hard-earned money and navigate the complexities of tax planning more effectively.

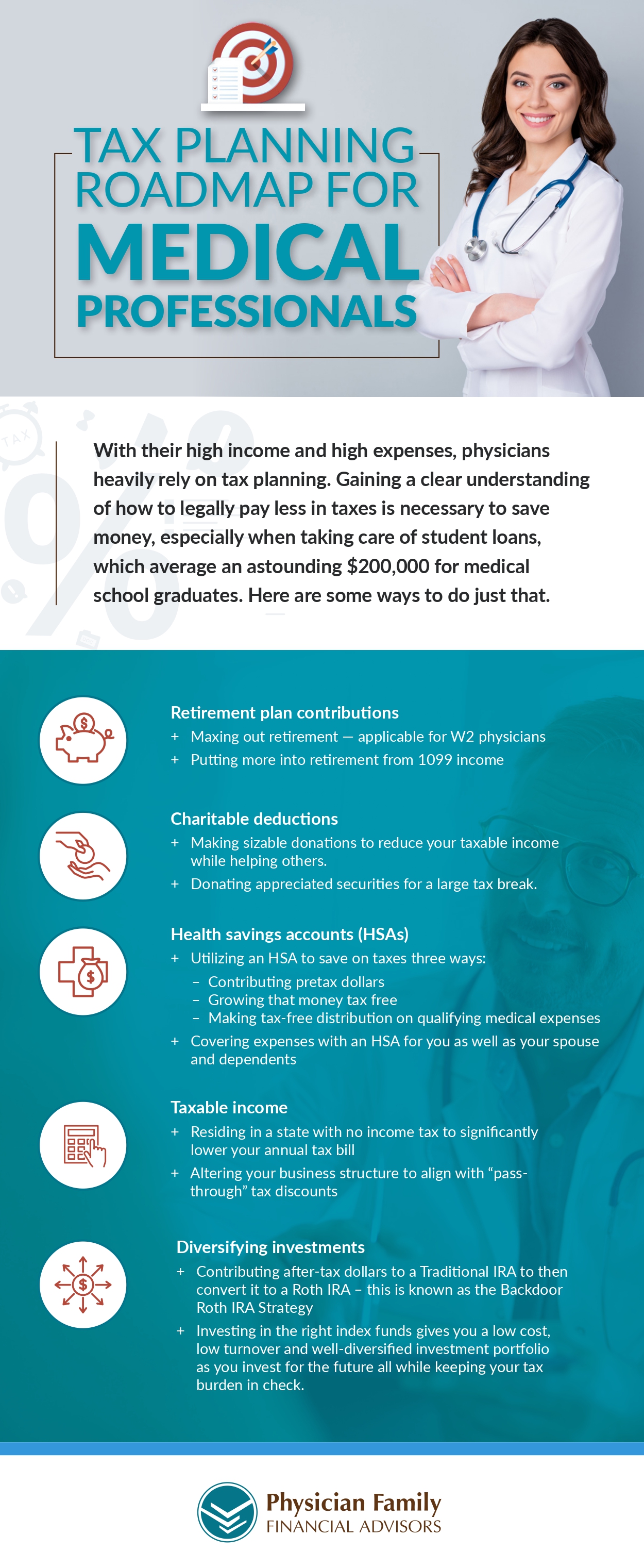

Tax Planning Roadmap for Medical Professionals from Physician Family Financial Advisors, a provider of financial planning services for physicians